Insurance Customer Retention: 11 Best Strategies To Encourage Loyalty

For customers, insurance often feels like a faceless, machine-led process. Their details are automatically entered into predictive models, categorized into risk-dependent groups, and given a green or red light in seconds.

For a competitive advantage, you need to humanize all elements of your digital customer experience (CX) so buyers don’t feel like a number on your spreadsheet.

If you can do this successfully, you’ll build stronger connections and create long-term relationships that lead to higher retention and advocacy.

In this article, you’ll learn why insurance customer retention is particularly tricky. Then, we’ll cover 11 strategies to help you stand out in a traditionally transactional industry.

Insurance professionals know that traditional models involve undercutting competitors, even if that means making a loss on the first year’s policy. Then, premiums will increase gradually over the next few years.

Without this knowledge, your long-term customers simply see another agency offering a similar product at a lower price.

Aside from cost, 46% of people cite customer experience as a top factor when choosing providers. If you don’t offer a seamless experience or valuable perks, the price difference alone may entice people to switch.

But that’s not all the industry is up against. Here are three more reasons why customer retention in insurance is an uphill battle:

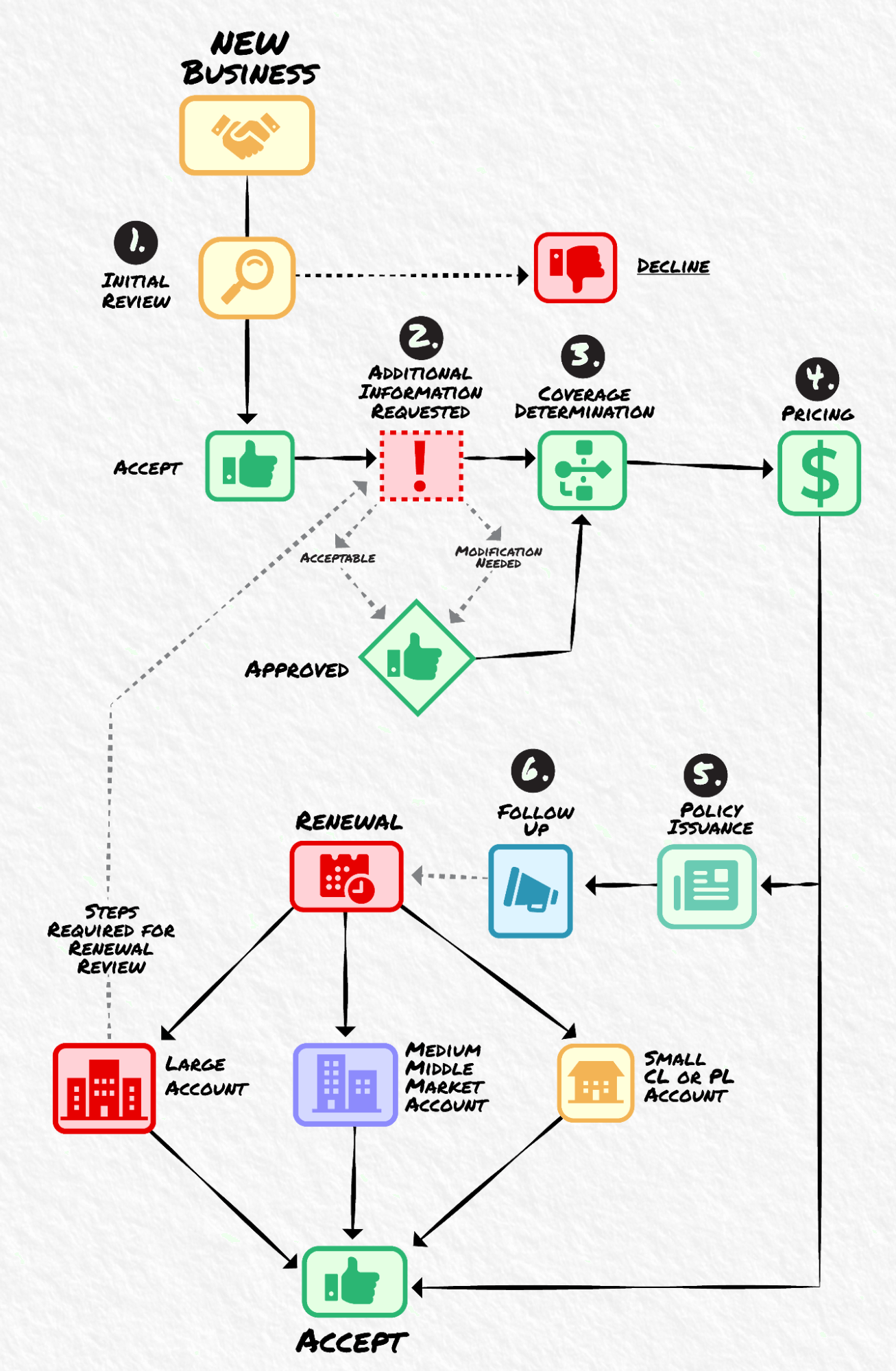

It’s no secret that a vast amount of hard data and facts, including trends and past losses, drives underwriting.

Insurance customers know they’re typically reduced to “numbers” that follow a flowchart of set processes. So, it can be challenging to convince them you truly value their business.

Here’s what that can look like:

Source: The National Alliance

Humans aren’t always involved in policy decision-making, so the process can feel faceless and impersonal. If all experiences are similar, customers will be more likely to switch to save money.

In most countries, insurance companies are subject to legal and regulatory requirements to ensure consumers get fair and transparent information before signing contracts.

For example, most governments require insurance companies to legally hold a minimum amount of capital to stay in business. If insurance agencies make promises they can’t keep (e.g., long-term low premiums), there’s a substantial financial and legal risk.

There are even regulatory bodies whose sole focus is to monitor insurers and their business practices to ensure they stay in line. In France, this supervisory authority is the ACPR (Autorité de Contrôle Prudentiel et de Résolution).

People usually buy insurance to protect high-value purchases (e.g., cars and home contents) because they feel they have to. Not because they want to.

That means insurance is more often a reluctant purchase than something customers get excited about. Because of that, it can be challenging to build engagement that leads to a high customer retention rate.

But it isn’t impossible.

Trying to encourage insurance clients to stick with you during economic uncertainty can be challenging — especially when competing with market-beating offers for new customers.

Here are 11 strategies that can keep policyholders coming back year after year:

Trust is crucial when customers rely on you to protect high-stake assets and support them during stressful times.

It doesn’t help when ultra-tight insurance companies refuse to pay out and make headlines, sowing distrust and placing all brokers under intense scrutiny. And when trying to convince people to buy a product they may never need, building trust from the outset is vital.

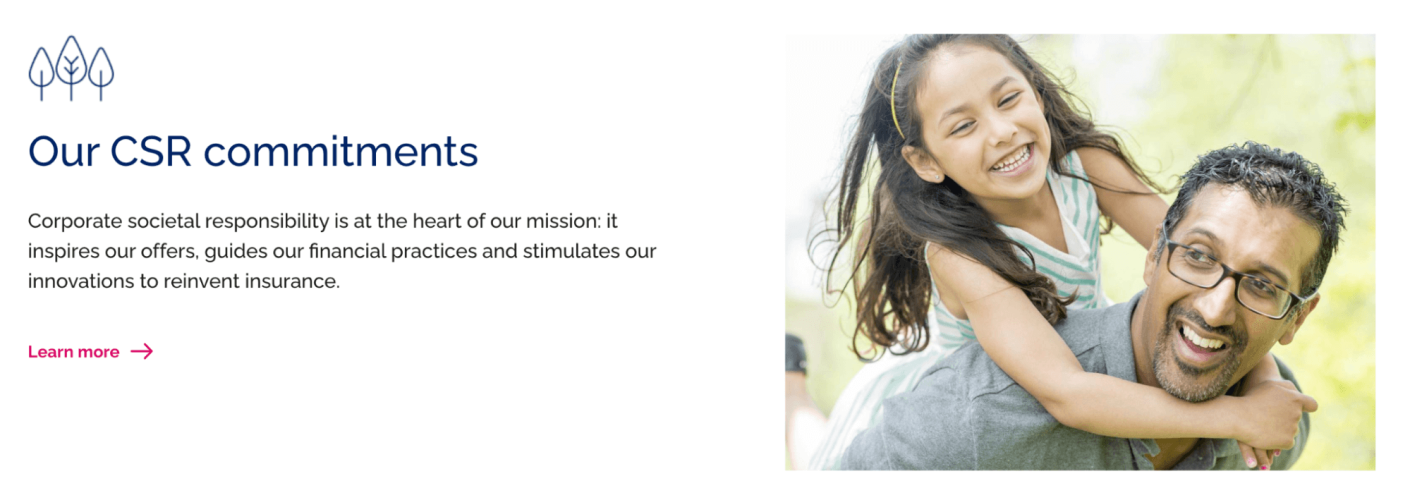

To do that, some insurers showcase their commitment to responsible practices.

According to Bain research, 80% of respondents want insurers to demonstrate environmental, social, and corporate governance (ESG) initiatives. This is likely because a company’s impact in these areas can indicate how trustworthy it is.

Personal insurer CNP Assurances highlights its corporate social responsibility (CSR) commitments on its homepage:

Companies who highlight CSR usually do it to convey how they positively impact society and hold themselves accountable. So, CNP Assurances places this information high on its homepage as a trust signal.

UK insurer Lemonade’s Giveback program donates leftover policyholder premiums to charitable causes.

The company takes a flat fee for the service and lets customers pick a nonprofit they’re passionate about. Then, it directs any unclaimed money toward that charity every year.

You can build trust between your insurance company and customers by:

Using these tactics regularly conveys why your company is the right choice for customers, even when your premiums may be a little higher.

Your onboarding process can set the tone for your entire CX. If it’s targeted and engaging, customers are more likely to view your brand through the same lens.

Customers will have different onboarding preferences. Some may prefer one-to-one walkthroughs, while others want self-service options, documentation, or video tutorials.

You can cater to all of these customers’ needs by offering a choice of formats and mediums. For example, you may offer a premium co-browsing experience (a more secure form of screen sharing) where your agents walk new clients through their insurance policy dashboards.

Visual assistance like this can also build a personal connection that lets you demonstrate how you appreciate every customer’s business.

However you onboard customers, don’t overwhelm them with information and jargon. Instead, ensure instructions are straightforward so that new policies can start off on the right foot.

It’s far easier to switch from one policy to a more cost-effective deal than to find numerous substitutions for home, life, and auto insurance.

An older study found that customers who bundled home and auto policies with one company had a 95% retention rate. However, only one in 10 customers nowadays have been with their insurer for over five years, suggesting people still shop around.

For optimal client retention, encourage cross-selling and upselling among your sales reps. To sweeten the deal for customers, offer discounts and special offers for multiple or premium products.

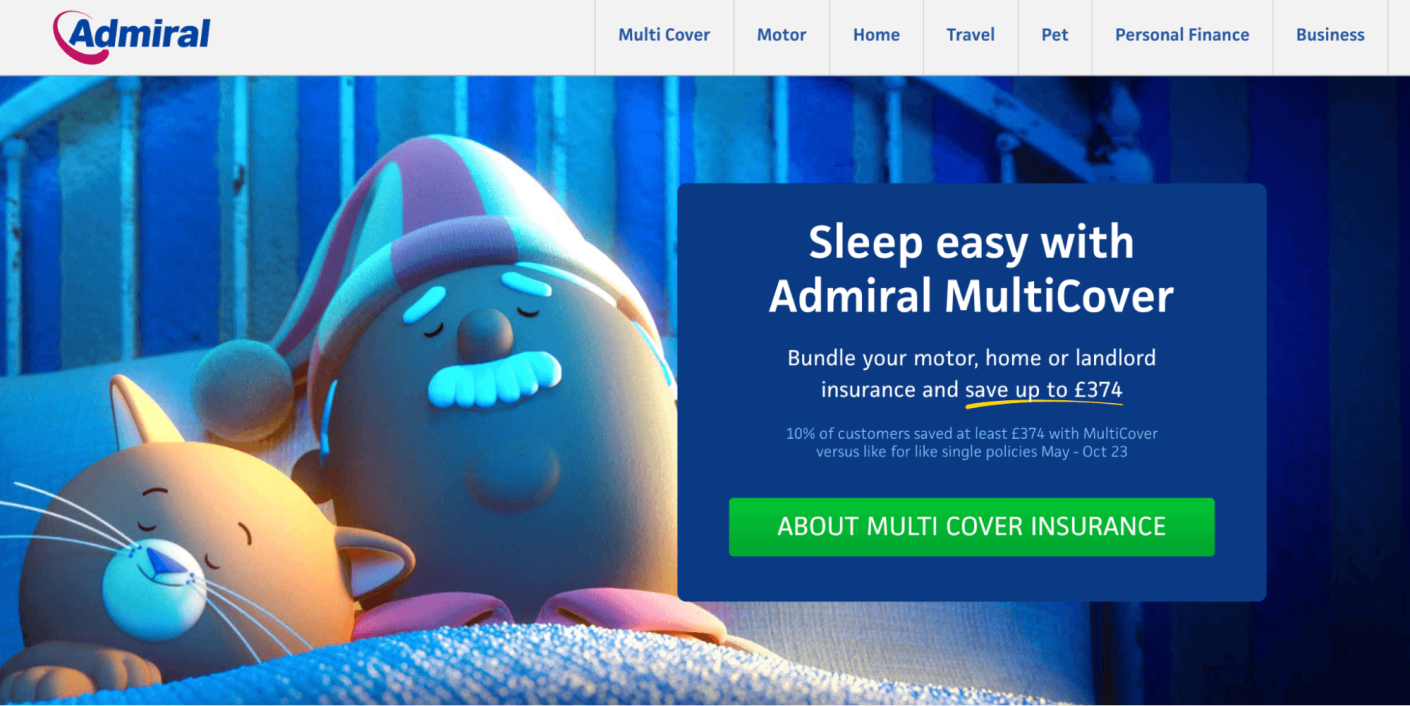

For example, UK-based Admiral offers multi-cover insurance that saves policyholders up to £374 when they bundle auto, home, or landlord cover.

In addition to giving customers the chance to save money and effort by insuring their valuables with one company, Admiral improves “stickiness” by encouraging loyalty.

Sometimes, it’s easier for busy customers to stick with you rather than research and switch multiple policies. Adding a financial discount can create even more incentive to stay.

Offering a range of reassuring visual claim support options can enhance your policyholders’ satisfaction by meeting them where they’re most comfortable.

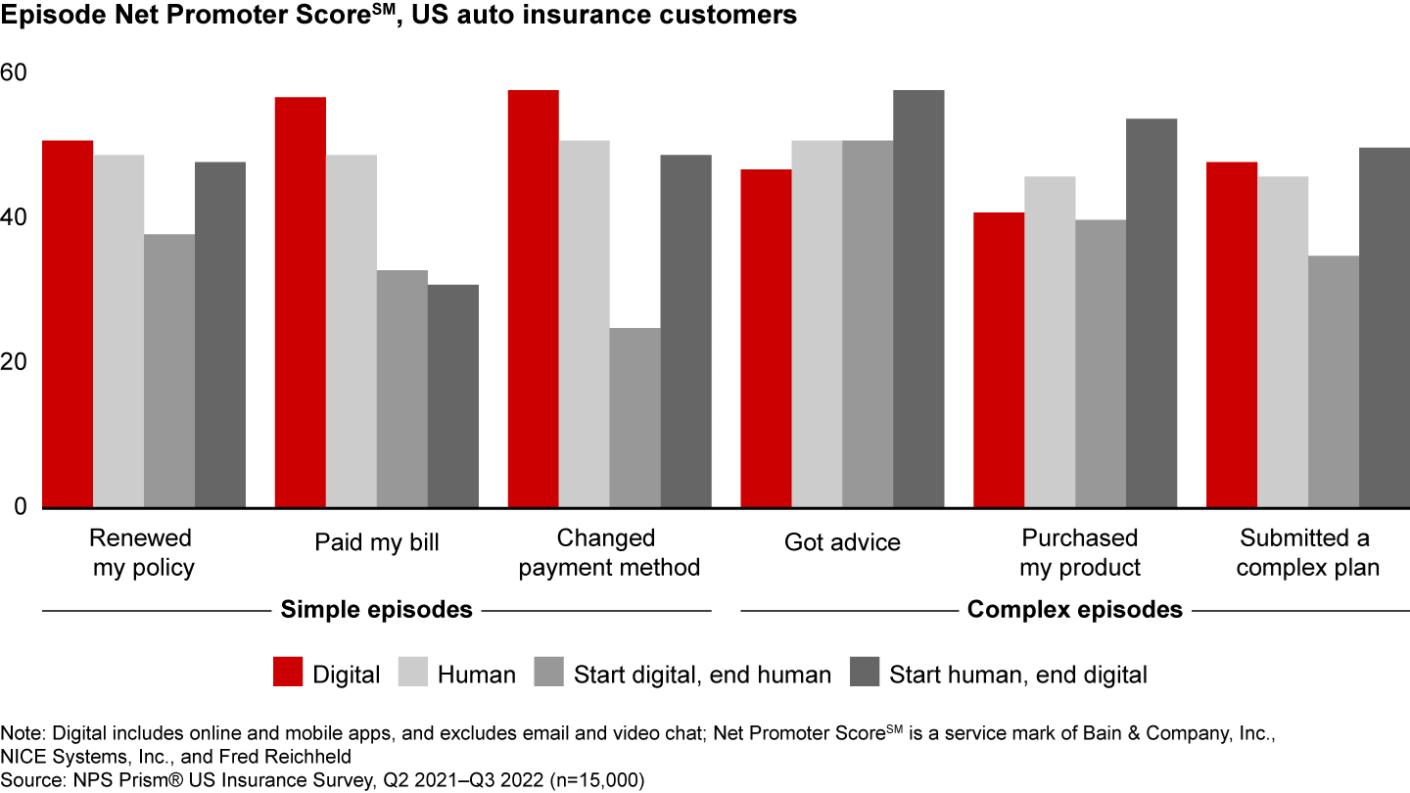

Bain research suggests US auto insurance customers prefer digital channels for more straightforward tasks (e.g., changing payment methods) and human-digital hybrid experiences for more complex tasks (e.g., purchasing a policy).

For example, some customers may want to express themselves face-to-face with a rep in emotionally charged claims or loss adjustment situations, while others may want to type over live chat to explain their thoughts clearly.

Accenture research suggests that 49% of consumers trust human advisors when making a claim, while only 7% trust chatbots. That’s why it’s good practice to have multiple options.

Tip: Learn more about chatbot vs human support options and when to use each effectively.

You can use Apizee’s visual engagement tools to offer video chat for those customers who want reps to walk through complex or nuanced insurance coverage in real time.

Offering this type of support to insurance customers can help:

It can also help boost other customer experience metrics like average resolution time, as agents have the tools to answer queries quickly and more effectively.

Independent loss adjuster Eurexo liaises between insurance companies and customers who file claims. The organization uses Apizee’s annotation technology to share notes and comments during video appraisals and draw descriptive diagrams.

Doing so helps customers reach “aha moments” faster with visual aids and cues rather than disengaging with a wall of text in an email or document.

Becoming an omnichannel business means unifying all your touchpoints and channels, including your website, app, email marketing, live chat, SMS, and social media messaging.

An omnichannel contact center aims to create one seamless experience for customers, allowing them to jump from platform to platform and pick up the same conversation with different reps who have all the previous context on their screens.

Let’s say an insurance customer has a problem viewing their online policy. They may start with a phone call and find out from your agent that the website is down due to technical issues.

Later, the same customer contacts you via X (formerly Twitter) to ask if the website is back up. Another of your agents confirms it is, and viewing the policy shouldn’t be a problem.

The customer still can’t load the document, so the rep sends an SMS via Apizee with a secure link to start a video chat.

After asking for permission, the agent accesses the customer’s account and shares their screen to walk through the issue. The agent points out that the customer has been trying to open an expired policy and shows them where to find this year’s document.

The customer is happy, the video ends, and the agent can no longer access the customer’s account — all thanks to omnichannel and visual assistance.

Insurance companies are one of the lucky few that have abundant and rich data from their customer base. While other companies need to scrape together age, location, job specifics, hobbies, and interests over time, potential insurance customers willingly input all this to get the best deal.

Personalization is a huge CX focus for many industries. But the standardized approach of traditional insurance agencies tends to lump customers into generic, categorized groups.

However, almost 70% of consumers would share personal data in exchange for lower insurance prices.

For example, French insurer Direct Assurance offers a YouDrive program that analyzes customers’ driving habits and adjusts premiums by up to 50% for safe drivers.

Source: Direct Assurance

Each driver equips their car with a “Drivebox” and gets a personalized score that dictates the discount on their monthly premium.

All this knowledge can help you personalize products and customer journeys to retain clients for longer and generate higher-quality leads.

For example, you may segment your policyholders into targeted groups, like first-time drivers and HGV (heavy goods vehicle) companies. From your market research and internal data, you know the interests and pain points of both widely differ.

With all this information, you can adjust the type of content you send to keep it more relevant.

To new drivers, you may send details about the UK’s six-hour Pass Plus course as it can lower insurance premiums.

HGV drivers will be more interested in covering legal liability for damaging other people’s property.

You can use these valuable details to create custom policies to match each customer’s unique circumstances.

Every company has to earn customer loyalty. However, insurance agencies are often already set up with the first-party data they need to do so.

As well as chasing single customers, target businesses to increase retention and profitability, and reduce customer acquisition costs. You can achieve this by offering deals to supply insurance as part of employment packages.

For example, companies may offer dental plans or private health insurance as recruitment perks for new hires.

Here are some of the insurance benefits that customer insights platform Maze offers:

Source: Maze

In addition to health insurance, the company offers life and disability insurance for employees and their families.

Before switching from selling to single customers, it’s important to note that the buying cycle for B2B (business-to-business) is much more complex than B2C (business-to-consumer).

Instead of convincing one person to buy, you may need to deal with around six to 10 decision-makers.

The benefit? You get more customers in one deal who are likely to stay with you as long as they remain in their role.

According to Gartner, B2B buyers complete six “jobs” before finalizing a purchase:

Within a niche as high-risk as insurance, B2B journeys can take even longer from awareness to purchase.

It’s also important to note that you may put a lot of time and resources into a deal that may not materialize. So, make sure you mitigate any losses as much as possible.

Many companies focus the most on acquiring new business, sometimes taking long-term customers for granted. But you can’t afford to drop the ball when 76% of customers would go out of their way for better customer service.

Traditional insurance companies also tend to have “transactional” customer relationships, focusing on payments, renewals, and bills.

You can stand out by becoming a relational insurer that uses personal data to add human, personalized touches throughout a customer’s relationship with you.

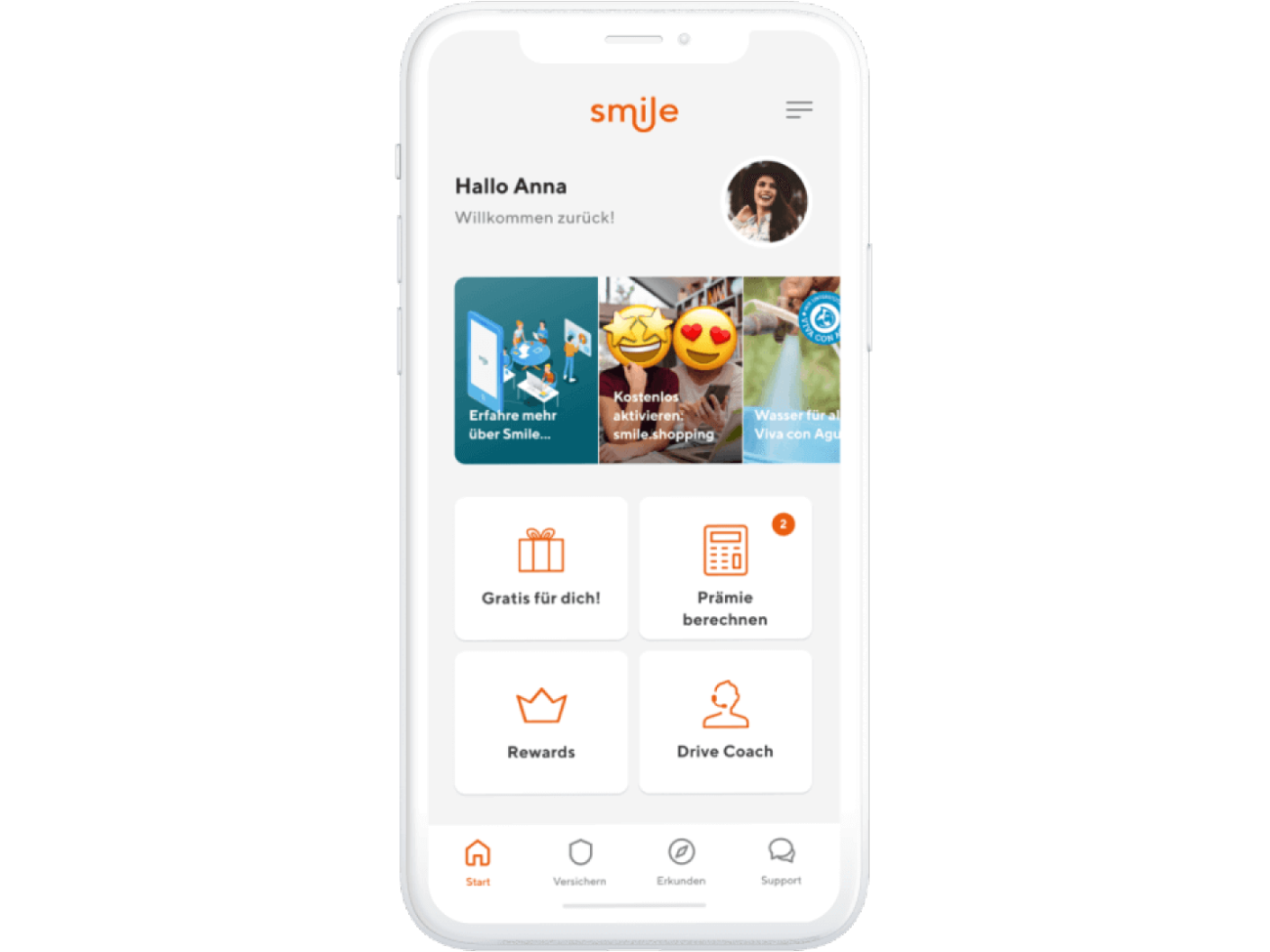

Doing so can be as simple as sending post-purchase thank-you emails from your founder or handwritten birthday and anniversary cards. You could take this further, like Switzerland-based Smile Insurance.

The insurer uses gamification and a community-building app to develop customer relationships, even if they’re not ready to buy yet.

Source: Smile

The app includes special offers from Smile’s partners, free protections for online shopping, and a points-based system for safe driving — all before you pay for anything.

This strong foundation the brand creates with prospects and customers has led to an average profitability of 90% over the past few years.

Little extras like these make policyholders feel exclusive and show you appreciate them. Doing so consistently builds deeper customer relationships that lead to loyalty.

Depending on the type of insurance you provide, customers have different priorities and services they value when looking for a provider.

Bain research suggests home insurance respondents want pre-purchase home inspections and threat alerts. For life and health insurance, 59% of life insurance policyholders want insurers to reward them for healthy living.

You can use this information to build a loyalty or referral program that offers these perks. For example, you may use a points system that rewards policy renewals and builds over time.

Customers can earn points through Vitality life insurance to trade for rewards if they quit smoking or track the calories they burn with their Apple Watch.

Source: Vitality

Doing so leads to gym membership and spa break discounts.

Perk preferences that encourage people to get involved in referral schemes and loyalty programs can also vary by customer segment. For example, single Millennial renters will have different priorities than Generation X homeowners with kids.

What you offer one age group may not appeal to another. So consider your internal and market research data for new and loyal customers and match them with best-fit perks.

Those single renters may appreciate gift cards for interior design stores, while customers with families may appreciate discounts for kids’ activities.

If you’re unsure what customers would like, ask for feedback through surveys or interviews. That way, you’ll offer incentives you know people will genuinely value.

It’s easy to fall into a pattern where you only get in touch with customers when it’s time to renew or prices increase. But this can quickly feel like a one-way relationship where you constantly take from them.

To avoid this, don’t just email when the policy is up for renewal. Instead, communicate more regularly with valuable messages that include:

Here’s part of an email from auto insurer LOOP where it informs customers about its upcoming rebrand:

Source: Really Good Emails

Instead of a generic update, the email opens with a heartfelt message that includes customers in the story:

“We started LOOP with the belief that if we price fairly, treat you with kindness, and invest in our communities, we could change the way the system works.”

Instead of a faceless insurer, LOOP includes a photo of the founders to humanize the message further. It also promises to advocate for the community that calls out injustice.

You can continue to communicate with and support your clients through a platform like email with both reactive and proactive messages like this.

Ensuring you stay top of mind while sharing your positive impact will make it easier for customers to choose to renew with you.

Proactively request customer feedback to spot potential problems before they churn. Understanding why people may be unhappy allows you to fix it before they take their business elsewhere.

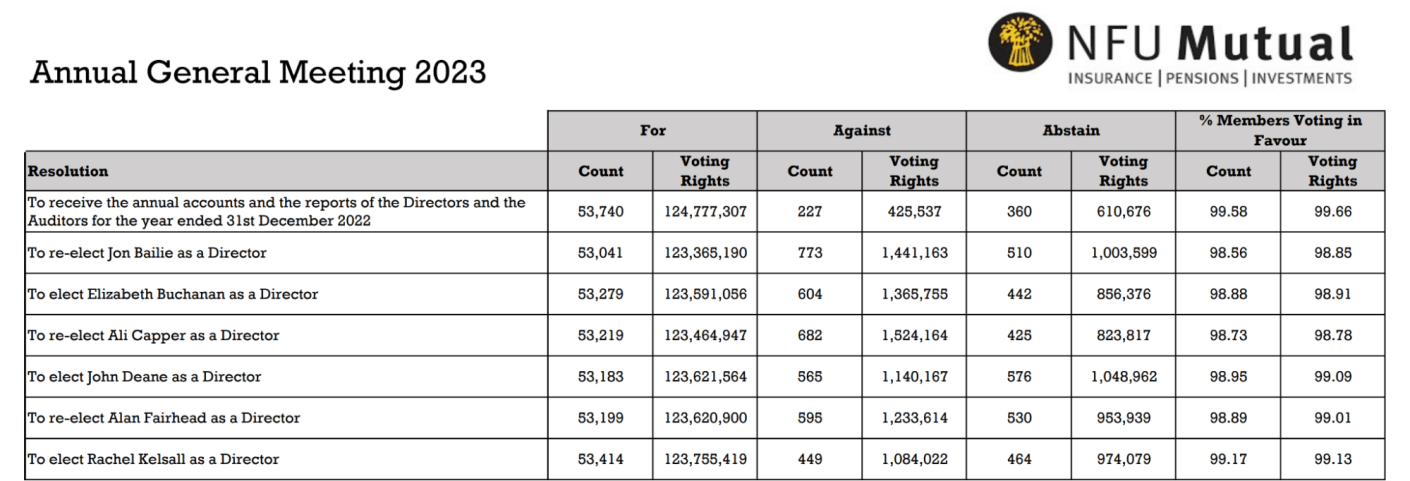

NFU Mutual is a prime example. It’s the highest-ranked UK insurer for customer experience, with top CSAT (customer satisfaction) metrics and NPS (Net Promoter Scores).

Tip: Try our Net Promoter Score calculator to determine whether your customers will likely recommend you.

As a “Mutual” organization, members (who have relevant products with the insurer) run it and have a say in its governance.

Here are some of the results of the latest AGM (Annual General Meeting), where members voted to elect previous and new Directors:

Source: NFU Mutual

This collective governance and highly-rated CX could be why nine out of 10 policies renew with NFU Mutual annually.

You can ask for feedback on all elements of your CX through:

Asking for customers’ input helps them feel appreciated and heard, especially if you implement their suggestions.

When learning how to retain insurance customers, it’s just as important to consider each individual as much as the collective.

Insurance is an old-school industry, but it’s crucial to adopt fresh thinking and try new approaches to meet customers where they are. How you target a customer in their early 20s at the start of their career will differ from that of those in the later stages, with homes and families to support.

Offering a wide range of channels and touchpoints can ensure you appeal to every type of customer throughout their journey.

Apizee can facilitate visual assistance for insurance customers who still want one-to-one interactions in today’s digital age.

Learn moreExplore key findings from the Genesys State of Customer Experience report. Learn how AI, omnichannel strategies, and video chat are transforming CX and enhancing customer satisf...

The State of Customer Experience report by Genesys : Key Insights and Trends

27 Mar 2025

Despite AI and automation, customers still prefer to speak to a human for support. Discover why human interaction remains essential for great customer service.

Why Customers Still Want to Speak to a Human in Customer Service

17 Mar 2025

Discover the top customer experience influencers in Europe, shaping the future of CX and customer service.

Top 100 Customer Experience Influencers to follow

10 Mar 2025

Interested in our solutions?