How To Calculate Your Customer Retention

Rate: Formula + Tips

To increase profitability, focus on keeping the customers you have.

Acquisition is often the north star focus for organizations, but acquiring a new customer can be up to 25 times more expensive than nurturing existing customers. Furthermore, the success rate of selling to customers you’ve already done business with is much higher (60–70%) than when trying to sell to new customers (5–20%).

To track whether you’re retaining existing customers, and increasing profitability, you need to know your customer retention rate.

In this article, you’ll learn what a customer retention rate is, how to calculate it (along with other important metrics), and how to improve it with a stellar customer experience.

Your customer retention rate (CRR) refers to the number of customers who stay at your business over a given period of time, expressed as a percentage.

A high customer retention rate typically signifies a happy customer base having a positive customer experience.

For example, Netflix is often lauded as a platform that delivers an excellent customer experience focused on algorithm-led personalization. They manage to retain nearly three-quarters of their customers over a six-month period (72%), signalling that people want to stick around after signing up.

Compare your rate to others, making sure you’re remaining competitive across industry-wide benchmarks. (We’ll cover these benchmarks in a moment.)

Here are four reasons why customer retention rate is a critical metric to track for any business.

By measuring your customer retention rate and determining how many people are repeat customers, you can estimate potential revenue.

Combining that estimate with your typical customer acquisition rate can provide a rough forecast of monthly (or even yearly) earning estimates.

Revenue forecasting can help you make a number of informed decisions (e.g. what tools to add to your tech stack, if you can bring on new hires, etc.).

Customer service quality has a major impact on retention, satisfaction, and loyalty. 48% of consumers have admitted to switching brands in search of better customer service.

You may need to optimize your customer service offerings, such as digitization, to ensure you’re providing the best service quality possible to increase customer retention.

Satisfied customers will continue to come back and buy from your business—unsatisfied customers won’t. So your customer retention rate helps to showcase your overall customer satisfaction level. If you have a low CRR, there may be some underlying issues that need to be revisited.

The customer retention rate also helps you determine customer loyalty, a slightly different metric to satisfaction. Customer satisfaction helps you measure customer attitudes toward your business while loyalty helps you predict whether customers will return. The two go hand in hand (i.e. satisfied customers are often loyal customers), but it’s important to recognize the distinction while measuring both.

Cross-selling involves selling a customer complementary items on top of their current purchase. Upselling is the act of selling a customer on an upgrade, a more premium package, or a higher-end product.

If customers continue coming back, they’re likely to gain interest in your other products or services, such as adding on extra items or upgrading to a more premium plan. This, of course, bolsters your revenue and potentially increases your customer lifetime value (CLV).

If you have a low customer retention rate, there might not be anything wrong with your customer service. It could just mean that your product isn’t valuable enough for customers to stick around.

See if there’s anything else you can offer at the level of product or service that competitors are already doing. You might also need to adjust your pricing to better fit the real value that your product or service offers.

You can measure your customer retention rate over any standardized period. However, many businesses choose to do so monthly or quarterly to get an idea of expected monthly or quarterly recurring revenue (MRR or QRR).

Keeping track of this metric consistently will also allow you to see if there has been a drop in retention so you can address potential impacts.

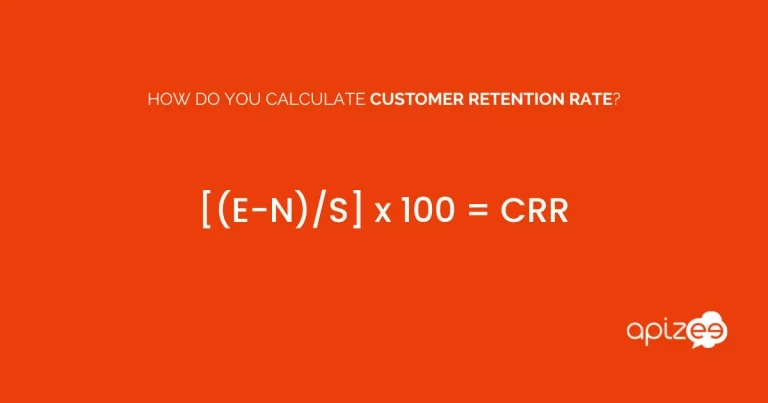

The customer retention rate formula is as follows:

Customer Retention Rate = [(Number of Customers at End of Time Period – Number of New Customers During Time Period) / (Number of Customers at Start of Time Period)] x 100

Let’s say you’re measuring the customer retention rate of your SaaS company for the last month. You had 1,500 subscribers at the start of the period and then acquired 400 new customers. Your business then had 1,700 subscribers at the end of the period. (This means you had 200 churned customers during the given time frame.)

You would calculate your customer retention rate like this:

Customer Retention Rate = [(1,700 – 400)/1,500] x 100

So your customer retention rate would be 86.7%. That means 86.7% of your existing customer base has stuck around throughout the entire month and into the next. This also means your customer churn rate (the inverse—how many customers you lost in that month) is about 13.3%.

According to data from Statista, here are some benchmark CRRs for various industries:

Your customer retention rate shows you how many customers you’ve retained over a given period of time. Your churn rate is simply the inverse. It shows you the total number of customers you’ve lost over a given period of time.

When you calculate your retention rate, you’ll find your churn rate at the same time. For example, if your customer retention rate is 73%, your churn rate will be 27%.

Churn rate can be calculated as follows:

Churn Rate = [(Number of Customers at Start of Time Period – Number of Customers at End of Time Period) / (Number of Customers at Start of Time Period)] x 100

Tracking this helps you ensure that your retention is higher than your churn rate. A high retention rate is good, and a high churn rate is not.

Having a good customer retention rate is a sign of a healthy business that provides a quality customer experience. But if you’re not satisfied with your customer retention rate, or you simply want to increase it (who doesn’t?), creating a customer retention strategy can help you so do.

Simply start using the right tech stack, tracking the appropriate KPIs, and creating various customer touchpoints along the journey that encourage customer engagement and retention.

Follow along with these eight best practices to further improve your CRR.

Tracking your customer retention metrics is key. (We’ll cover three more important ones shortly.) Add your CRR to a monthly tracking dashboard to get an idea of how your overall retention and satisfaction are doing. You can use a tool like Databox or Tableau to help you build this out.

Keeping an eye on these metrics will also tip you off early if your numbers start to decline. Track fluctuations to see if there are any patterns throughout the year. Get an idea of where there might be any issues in the customer journey that you can address before they make a major impact on retention.

Good onboarding helps fuel retention. If you make sure your customers know how to make the most out of your product or service, they won’t see the need to look elsewhere for a solution.

80% of users have deleted an app because they didn’t know how to use it. According to the same study, 86% of consumers say they’d be loyal to a company that invested in educational onboarding materials.

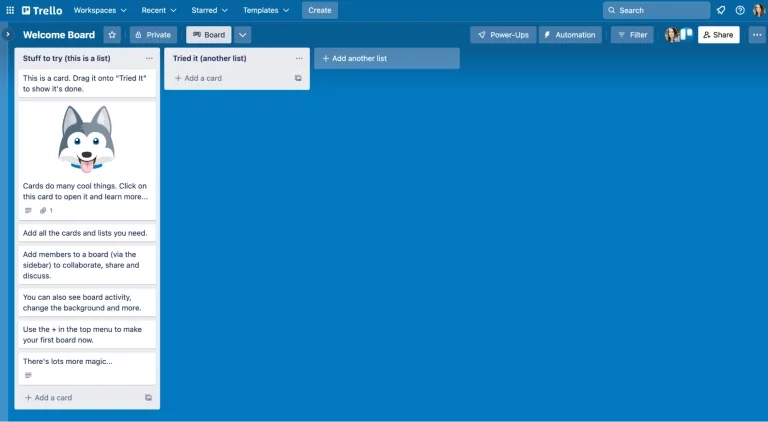

Trello does a great job of this by auto-generating a “Welcome Board” for new users that demonstrates how to best use their project management software.

Create an onboarding strategy that fully walks customers through how to use your product so that they won’t have questions or concerns down the line. But if they do, offering both self-service and full-service customer support options is key. (More on this later.)

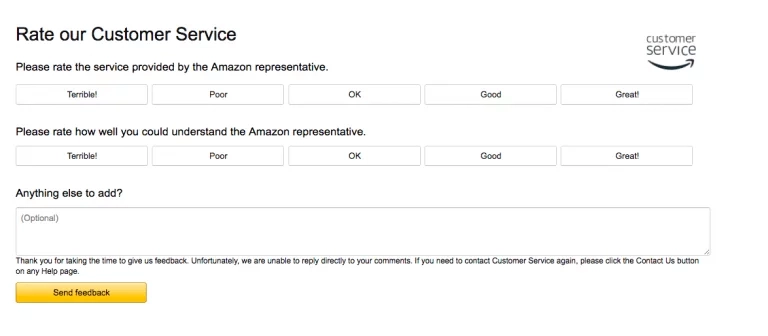

If you want to understand why customers are staying or going, the best people to ask are your customers. Create customer feedback surveys that allow you to gather insights into how your customers feel about your business.

You can always start with a simple Net Promoter Score survey at check-out or sign-up that lets you see how many promoters versus detractors you have.

But you can also create a survey that’s more in-depth that you send out via email. You might send this out after a customer service inquiry or after someone has been a customer for a certain amount of time.

Here’s an example of what this survey might look like:

Source: Hubspot

Keep it short and to the point. And always make sure to implement changes based on the overall sentiment of the feedback you’re receiving. If customers are stating that they want access to more features or that the signup process is too clunky, you have a starting point for implementing updates to improve customer retention.

Loyalty programs can help increase customer retention. 79% of customers say a loyalty program makes them more likely to continue doing business with a brand. If you’ve been on the fence about building a loyalty program, it’s time to start.

Loyalty programs can be as basic or as in-depth as you want them to be. Do something as simple as offering discounts or promos to return customers. Or consider something more complex, like creating a multi-tiered rewards program based on spending with varying perks.

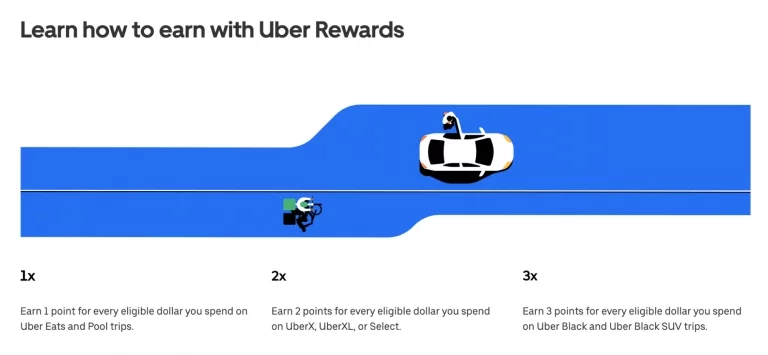

You can even create an official rewards program like Uber. They offer points in exchange for Uber and UberEats uses.

The points, called Uber Cash, can be used for more rides and food delivery services. This entices customers to continue using their app in an attempt to generate more rewards.

Can you offer some type of subscription to your customers? Ecommerce businesses can create subscription boxes or kits, while B2B organizations might consider getting clients on retainer. SaaS tools often operate on a subscription model anyways.

Doing this helps you gauge monthly revenue much more accurately. Plus, it can help aid in customer retention. When you know you have customers signed up on a month-to-month basis, it gives you a longer working relationship and more chances to prove your business is worth their loyalty.

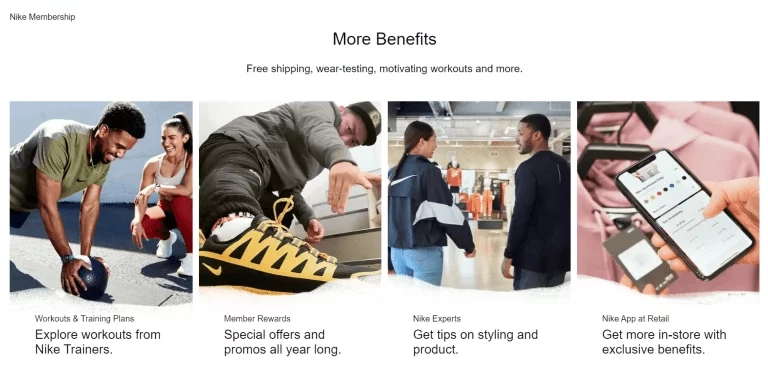

For example, shoes might seem like something that doesn’t need a subscription. However, Nike has cleverly designed a subscription model that offers value to their customers while encouraging them to return the next time they need activewear.

Nike’s free subscription includes guided runs and workouts, so members can put their Nike products to use. They also get exclusive access to new products, members-only offers, and personalized tips. An excellent way to keep your customer base active and thinking about your product.

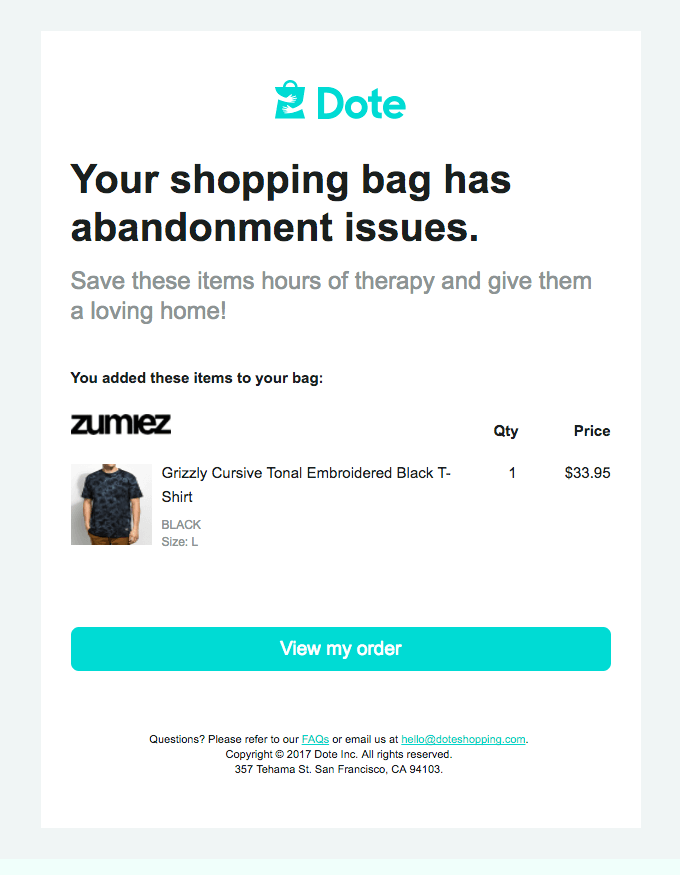

Ecommerce stores often see customers start a new shopping experience without finalizing the purchase. Cart abandonment campaigns, such as retargeting ads and email reminders, can be a great way to ensure customers go through with their repeat purchases.

Here’s an example of what such an email might look like:

Source: Really Good Emails

You can also take advantage of social media retargeting ads to remind customers of what they haven’t yet finished purchasing.

We’ve already touched on cross-selling and upselling, but it’s an important part of customer retention. By reaching out to existing clients and customers about upgrades or complementary products, your team can easily turn a one-time customer into a repeat customer with little effort.

This can be done individually by your sales team or through personalized email messaging and online advertising. Consider the best approach for your business and customer base, then see if you can start upselling or cross-selling to your existing customers.

A few tactics include:

Make sure that you’re only offering relevant products or features to each customer; otherwise, they have no incentive to add anything else to their cart or increase their plan tier.

88% of customers say the experience a company provides is just as important as the products or services that it offers. This means investing in your support strategy is a necessity.

While optimizing and improving, take a look at your customer support channels. You want to be able to reach customers on all of their preferred channels. 28% of customers say having multiple communication options is part of a good customer service experience.

Some options and tools to use include:

AI tools, chatbots, and email support are easy ways to help customers in need of basic assistance. However, you need to make sure your customers still have access to that ever-important human element.

This can easily be done with tools like Apizee by offering personalized video communication that makes resolving customer issues much more pleasant. Customers can request support, walk agents through the issue, replicate it right on the screen, and get immediate help.

Customer service can have a major impact on customer retention. 97% of customers reported changing their buying behavior due to a bad customer service experience with a company.

Make sure you’re consistently offering high-quality customer service across every channel you offer. And don’t forget about the human touch that helps your customers relate to your business even more.

Your customer retention rate tells you how many customers have continued working with your business. But it tells you nothing about the customers that left and what may have driven them away.

Is it your customer service? Is it the buying process? Are your products or services not up to snuff? There are other metrics to track as a part of your customer retention strategy that can help.

Revenue churn is similar in concept to customer churn. It tells you how much revenue (rather than users) your company has lost due to customer cancellations or downgrades within a given time frame.

Revenue Churn = (Net Revenue Lost in a Time Period / Total Revenue in a Time Period) x 100

For example, if you generated $100,000 in a month, but lost $10,000 due to canceled plans or subscriptions, you saw a 10% revenue churn. This metric lets you see how customer churn is actually impacting your bottom line.

Repeat purchase rate refers to the number of customers who have made repeat purchases. This is particularly useful for retail and ecommerce companies.

Repeat Purchase Rate = (Number of Repeat Customers / Total Customers) x 100

If you had 50 repeat customers out of 200 total customers, your repeat purchase rate was 25%. It’s helpful to track how many customers are buying from your company again instead of heading to a big-box store or a competitor.

Some businesses also measure loyal customer rate. It uses the same calculation as above but only includes the number of customers who made more than two purchases (or their business’s purchase threshold for customer loyalty) rather than the total number of repeat customers.

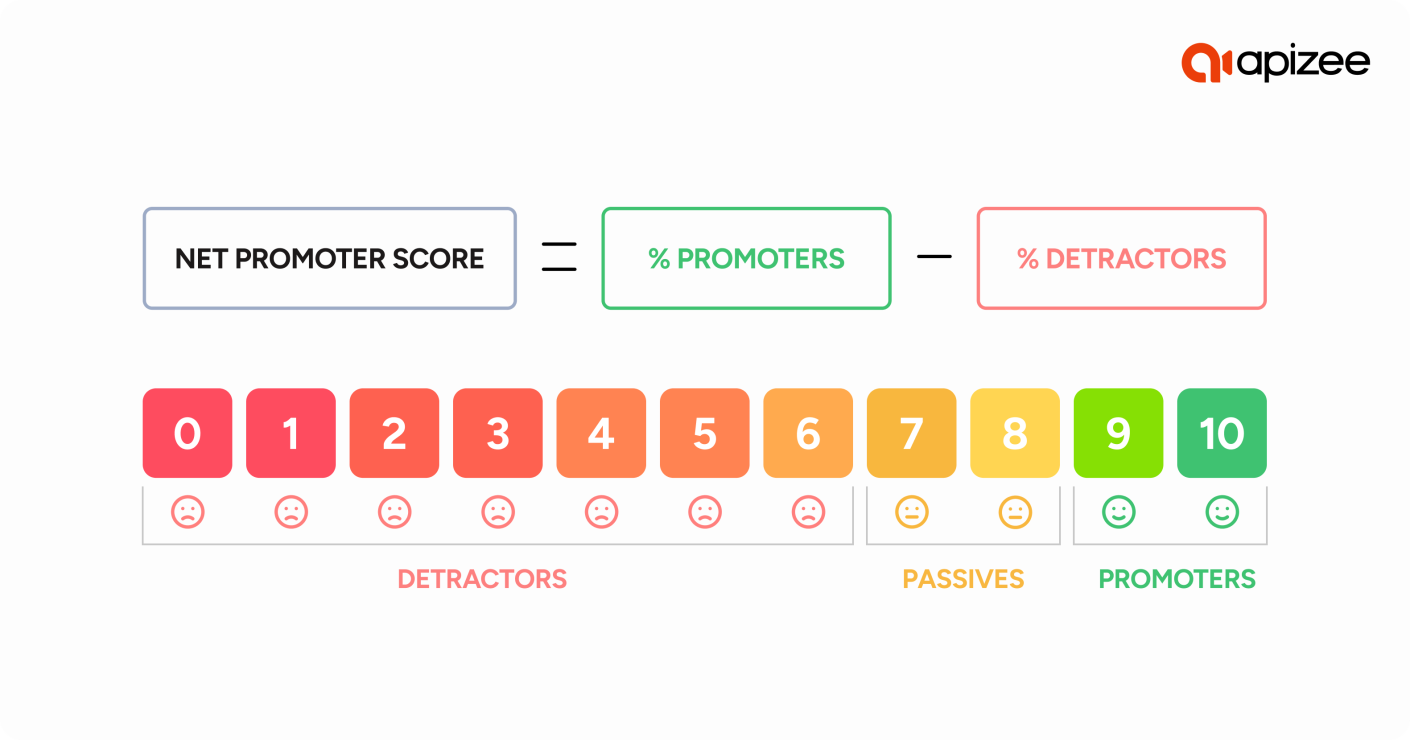

Net Promoter Score (NPS) helps businesses measure customer loyalty and how likely their existing customers are to send referrals their way.

This data is gathered with a simple one-question survey often sent out right after a transaction has occurred, such as: “How likely are you to recommend us?”

The responses are then broken into category ranges.

By gathering these survey responses, companies are able to identify customers that may need additional attention to improve their experience. NPS essentially measures customer sentiment and how your audience feels about your business.

Customer retention should be a big part of your customer success strategy. Measure your CRR each month or quarter so you know how much of your overall customer base is remaining loyal. Then put parameters into place in order to improve that rate and retain even more customers. Apizee can help—start ramping up your customer support solutions today with video assistance.

Explore the top customer service trends for 2026—a quick look at what’s shaping customer expectations and behaviors in the year ahead.

Customer service: trends not to miss in 2026

8 Dec 2025

Here is the list of best Call Center Conferences to attend in 2026. Check out the top events, summits and meetups globally that you can plan for this year.

List of Best Call Center Conferences to Attend in 2026

1 Dec 2025

Best Customer Experience Conferences to Attend in 2026

1 Dec 2025

Interested in our solutions?